Esports and Betting: Africa’s Next Big Thing?

The convergence of esports and betting represents one of the most dynamic emerging opportunities in Africa’s digital entertainment landscape. As internet infrastructure improves and smartphone penetration reaches unprecedented levels across the continent, competitive gaming is gaining rapid traction among Africa’s predominantly young population. This demographic alignment creates natural conditions for esports growth, with nearly 60% of Africans under age 25 and increasingly connected through mobile devices. The potential marriage between this growing esports audience and the continent’s already established betting ecosystem presents compelling business opportunities and cultural implications. Industry analysts have begun identifying Africa as potentially the next major growth frontier for global esports, with several indicators suggesting the continent could follow accelerated adoption patterns similar to those seen in Southeast Asian markets over the past decade.

The Current State of Esports in Africa

The African esports ecosystem is developing rapidly but unevenly across the continent, with distinct regional hubs emerging in South Africa, Egypt, Nigeria, Kenya, and Morocco. These markets have established the continent’s first professional teams, regular tournament circuits, and dedicated esports venues. South Africa currently leads the continent’s esports development, hosting Africa’s largest gaming competitions with prize pools now reaching six figures in USD equivalent. The competitive scene focuses primarily on mobile esports titles like Free Fire, PUBG Mobile, and Mobile Legends, reflecting the continent’s smartphone-first technology adoption patterns. Traditional PC esports including Counter-Strike, League of Legends, and Dota 2 maintain smaller but dedicated communities, primarily concentrated in urban centers with more developed internet infrastructure.

What distinguishes Africa’s esports development from other regions is its distinctive mobile-first evolution. While established esports markets typically developed initially around PC gaming before expanding to mobile platforms, Africa’s ecosystem is building primarily on mobile foundations. This pattern creates both challenges and opportunities, with mobile titles offering lower barriers to entry but historically commanding less international viewership and sponsorship compared to established PC esports. However, this mobile orientation aligns naturally with Africa’s technological realities while potentially positioning the continent at the forefront of global mobile esports growth.

Regional Competition Development

Tournament infrastructure across Africa has advanced significantly over the past three years, evolving from informal community competitions to structured leagues with corporate sponsorship and production values approaching international standards. Organizations like the African Gaming League, Gamr Africa, and Ace1 have established multi-country competition circuits that provide crucial competitive opportunities while developing broadcast capabilities essential for audience growth. These regional competitions increasingly serve as qualification pathways to global championships, providing African players with unprecedented opportunities to compete internationally.

Professional Team Ecosystem

Professional esports organizations have begun establishing sustainable operations across several African markets, creating essential infrastructure for talent development and competitive advancement. Teams like ATK, Goliath Gaming, and Sensei Esports operate multi-game rosters with professional management structures, training facilities, and sponsorship portfolios. These organizations increasingly provide salaries and development resources that allow players to pursue esports as legitimate career paths rather than mere hobbies, addressing a critical requirement for ecosystem maturation.

Infrastructure Challenges

Despite promising growth, significant infrastructure limitations continue constraining Africa’s esports development. Internet reliability, latency issues, and electricity instability remain substantial obstacles, particularly outside major urban centers. These challenges disproportionately impact PC esports titles that require consistent, low-latency connections for competitive integrity. The geographic distribution of fiber internet also creates significant competitive advantages for players in specific regions, potentially limiting talent development in less connected areas.

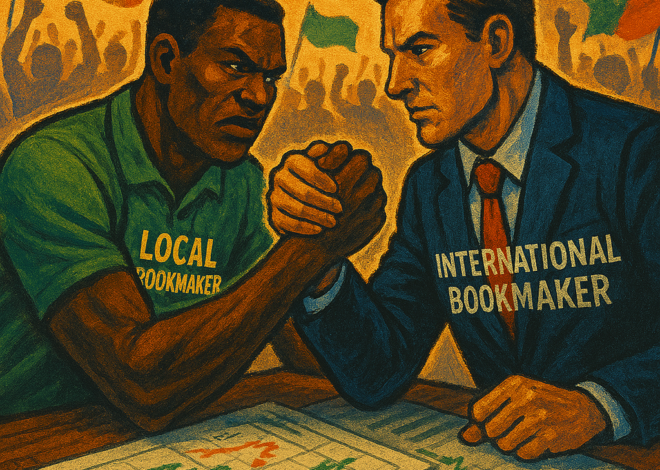

Betting Market Opportunities and Challenges

The potential convergence between esports and Africa’s established betting markets presents distinctive opportunities shaped by regional gambling preferences and regulatory environments. Early adoption metrics suggest significant interest, with several major African betting operators reporting 200-300% year-over-year growth in esports betting volumes since 2022. This growth outpaces global industry averages, suggesting potential for Africa to develop uniquely high engagement between esports viewership and betting activities. Multiple factors contribute to this accelerated adoption, including demographic alignment, natural synergies with existing sports betting behaviors, and the interactive nature of esports content.

Africa’s existing sports betting infrastructure provides natural advantages for esports betting integration, with established payment systems, regulatory frameworks, and customer acquisition channels readily adaptable to esports offerings. Leading African betting operators have begun developing dedicated esports sections within their platforms, expanding beyond simple match-winner markets to offer diverse betting options similar to traditional sports. These expanded markets include round winners, kill counts, objective completions, and various other in-game events that create engaging micro-betting opportunities throughout matches.

- Mobile esports titles generate significantly higher betting engagement than PC titles across African markets, directly contradicting patterns observed in Europe and Asia

- Live betting represents over 70% of esports wagering volume, substantially higher than the proportion for traditional sports betting

- First-time bettors are twice as likely to begin with esports than traditional sports when both options are equally promoted

- Tournament viewership increases by an average of 35% when integrated betting opportunities are available

- African bettors show particular interest in player-specific performance markets compared to match outcomes

- Regional competitions generate higher betting engagement than international events, despite smaller prize pools

- Average stake amounts for esports betting trend 15-20% lower than traditional sports, but with higher average transaction frequency

- Conversion rates from free-to-play prediction games to real-money betting exceed industry benchmarks by 40%

Regulatory challenges present significant considerations for esports betting development, with frameworks across many African jurisdictions not explicitly addressing virtual competitions. This creates potential compliance ambiguities that responsible operators must navigate carefully. Several countries have begun updating gambling regulations to specifically include esports, creating clearer operational parameters, while others maintain regulatory uncertainty that complicates market development. This evolving landscape requires operators to implement robust compliance systems that can adapt to emerging requirements while maintaining responsible gambling standards appropriate for esports audiences.

Mobile Gaming’s Dominant Position

Mobile gaming’s centrality to African esports creates distinctive market characteristics that significantly influence betting engagement and opportunity development. The continent’s mobile-first technology adoption has made smartphones the primary gaming platform for approximately 95% of African gamers, with feature phones still maintaining relevance in specific markets. This mobile dominance shapes everything from competitive title selection to viewing preferences and betting behaviors. The convergence of gaming, viewing, and betting activities on single devices creates particularly seamless user journeys compared to markets where these activities typically span multiple platforms.

The accessibility of mobile esports titles dramatically expands the potential participant and viewer base compared to traditional PC esports, which require substantial hardware investments. Popular titles like Free Fire and PUBG Mobile operate effectively even on budget smartphones with modest specifications, enabling participation across diverse economic backgrounds. This accessibility creates naturally larger player populations that subsequently drive viewing interest and betting engagement. The social aspects of mobile gaming, with friends easily able to compete together regardless of location, further amplifies community development essential for sustainable esports ecosystems.

Game Publisher Relationships

Major mobile game publishers have recognized Africa’s growth potential, establishing regional servers, localization initiatives, and tournament structures specifically targeting African players. Companies including Garena (Free Fire), Tencent (PUBG Mobile), and Moonton (Mobile Legends) have implemented progressive engagement strategies across the continent, creating foundations for sustainable competitive ecosystems. These publisher investments provide critical infrastructure that benefits the entire value chain from competitive play through viewership and associated betting activities.

Data Consumption Optimization

Specialized optimization for data efficiency represents a particularly important development in African mobile esports, with both game and streaming applications implementing technologies that minimize data consumption without significantly compromising experience quality. These optimizations address one of the primary barriers to widespread adoption, as data costs remain relatively high across many African markets compared to average incomes. Similar efficiency innovations for betting platforms that integrate with esports viewing experiences could provide significant competitive advantages in market development.

Cross-Platform Integration

Emerging integration capabilities between mobile games and betting platforms create uniquely streamlined experiences not widely available in more established markets. Several African betting operators have developed partnerships enabling direct API connections with popular mobile titles, creating capabilities for players to seamlessly transition between gaming and betting without switching applications. These integrations potentially reduce acquisition costs while increasing conversion rates through contextually relevant betting opportunities presented at natural engagement points.

The Role of Internet Infrastructure Development

Internet infrastructure improvements across Africa represent perhaps the most significant determinant of esports and associated betting market potential, with ongoing developments creating substantially expanded opportunities. The continent has witnessed remarkable progress in connectivity over the past five years, with submarine cable projects, terrestrial fiber expansion, and increasing 4G coverage transforming digital accessibility. These improvements directly impact esports by reducing crucial barriers including download speeds, latency issues, and connection stability. Looking forward, planned infrastructure investments suggest continued acceleration of these positive trends, potentially resolving many current limitations within the next 3-5 years.

The StarLink satellite internet service has begun deployment across several African markets, potentially creating transformative accessibility in regions where terrestrial internet development remains economically challenging. Early adoption data from South Africa and Nigeria suggests these services provide sufficient performance for competitive gaming even in remote areas, potentially democratizing esports participation beyond urban centers where opportunities have traditionally concentrated. This expanded accessibility could dramatically increase the addressable market for both esports participation and associated betting activities.

Internet Affordability Trends

Beyond physical infrastructure, internet affordability continues improving through competition, technology advancement, and policy initiatives designed to expand digital inclusion. Average data costs have declined approximately 30% over the past three years across major African markets, with further reductions projected as infrastructure investments achieve greater economies of scale. These affordability improvements directly impact esports engagement potential, particularly for streaming content consumption that drives audience development necessary for betting market growth.

Latency Improvements

Latency reduction represents a particularly important infrastructure development for competitive integrity in esports. Regional server deployments by major game publishers have significantly improved playing conditions for titles including Counter-Strike, Valorant, and League of Legends, creating more equitable competitive environments. These improvements directly impact betting market potential by ensuring results reflect skill rather than connection advantages, building essential trust in competitive integrity that underlies responsible betting activities.

Mobile Network Evolution

The ongoing transition to 5G networks across Africa’s more developed markets promises substantial performance improvements for mobile esports, potentially enabling more sophisticated competitive experiences previously viable only on PC platforms. While 5G deployment remains primarily limited to major urban centers, expansion roadmaps suggest broader accessibility within 3-5 years across numerous countries. This evolution could further strengthen mobile gaming’s dominance while enabling more advanced titles that create additional betting market opportunities.

Content Creation and Media Ecosystem

The development of Africa’s esports content creation ecosystem represents a critical foundation for betting market growth, as engaging media experiences drive audience development necessary for sustainable wagering interest. The past three years have witnessed remarkable evolution in African esports content production, with numerous organizations developing broadcasting capabilities, commentary talent, and production values approaching international standards. This media infrastructure creates essential context and narrative frameworks that transform competitive gaming from participant activity to compelling spectator experience capable of driving betting engagement.

Indigenous content creation remains particularly important for developing distinctly African esports narratives that resonate with local audiences. While international competitions attract viewership, regionally-focused content showcasing African players, teams, and storylines typically generates substantially higher engagement metrics. This localized content development creates natural opportunities for contextually relevant betting integration through partnerships between media producers and betting operators. Such collaborations potentially benefit both parties while creating more engaging viewer experiences when implemented responsibly.

- Regional language commentary has proven crucial for audience development, with viewership increasing by approximately 70% when native language options are available compared to English-only broadcasts.

- Mobile-optimized viewing experiences that minimize data consumption while maintaining core visual information show 40% higher retention rates compared to standard formats requiring higher bandwidth.

- Content formats integrating educational components that build game knowledge show particularly strong performance metrics, addressing the knowledge barrier that often limits betting engagement among new esports viewers.

- Localized content featuring regional tournaments consistently outperforms international competition broadcasts in engagement metrics despite lower production budgets, highlighting the importance of cultural relevance.

The development of African esports personalities and influencers creates particularly valuable opportunities for authentic market development. These content creators build trusted relationships with audiences that potentially transfer to associated betting activities when partnerships maintain appropriate responsibility standards. Several leading African betting operators have begun developing ambassador relationships with prominent esports personalities, creating content that combines entertainment value with responsible betting education appropriate for predominantly young audiences.

Demographics and Youth Engagement

Africa’s demographic profile presents both extraordinary opportunities and significant responsibilities for esports betting development. With approximately 60% of the continent’s population under age 25, Africa contains an unprecedented concentration of individuals within demographics that traditionally show highest affinity for both esports and betting activities. This alignment creates natural market potential but simultaneously demands exceptional responsibility standards given the vulnerability of younger audiences to potential gambling-related harms. Sustainable market development requires careful balancing of commercial opportunity with robust protection mechanisms appropriate for predominantly young audiences.

Research indicates African youth demonstrate particularly strong engagement with competitive gaming content compared to global averages, with mobile gaming activities already well-established across diverse socioeconomic segments. These existing gaming behaviors create natural pathways to esports viewership and potential betting interest as competitive ecosystems develop. The accessibility of mobile esports particularly resonates with younger audiences seeking entertainment options aligned with technological preferences and social participation opportunities.

Youth Protection Considerations

Age verification technologies represent a critical component for responsible esports betting development given Africa’s youthful demographic profile. Several leading betting operators have implemented advanced verification systems using combinations of telecommunication data, official identification validation, and behavioral analysis to prevent underage participation. These protection mechanisms require continued advancement to maintain effectiveness while providing seamless experiences for legitimate adult users, particularly given identification infrastructure limitations across some African markets.

Educational Integration

Educational approaches to responsible gambling represent particularly important components for African esports betting, with several operators developing specialized content addressing gambling literacy for predominantly young adult audiences. These programs typically focus on understanding odds, managing bankrolls, recognizing problematic behaviors, and maintaining healthy boundaries between entertainment and financial risk. When integrated naturally within engaging content formats, these educational components potentially build both market sustainability and consumer protection.

Cultural Considerations

Cultural attitudes toward gambling vary significantly across African communities, creating complex considerations for market development that respects diverse perspectives. Successful approaches typically emphasize the entertainment and skill-based aspects of esports betting while implementing community engagement strategies that address potential concerns through transparent communication and demonstrated responsibility commitments. Building sustainable acceptance requires ongoing stakeholder dialogue rather than merely implementing technical compliance with regulatory minimums.

Future Outlook and Market Potential

The convergence of esports and betting in Africa represents a market with extraordinary potential currently in early developmental stages. Current trajectories suggest the possibility of accelerated growth patterns that could potentially compress evolutionary stages observed in more established markets. Industry projections indicate African esports betting could reach $300-500 million in annual turnover by 2027, representing significant growth from current volumes estimated below $50 million. While substantial, these projections remain conservative compared to established betting categories, suggesting long-term development potential extending well beyond near-term horizons.

Several factors will determine whether African esports betting achieves its potential market scale. Continued infrastructure improvement remains perhaps the most fundamental requirement, as connectivity limitations still restrict participation across many regions. Regulatory development represents another critical factor, with clear frameworks that enable responsible operations while implementing appropriate consumer protections essential for sustainable growth. The evolution of payment technologies suitable for predominantly young, often underbanked populations will similarly influence adoption rates and market accessibility.

The potential for distinctly African innovation in esports betting merits particular attention. The continent’s mobile-first development patterns, unique demographic profile, and infrastructure constraints create conditions that potentially drive novel approaches not observed in more established markets. These innovations might include specialized micro-betting formats optimized for low-bandwidth environments, integration with mobile money systems beyond traditional banking infrastructure, and community-based betting models that incorporate social elements aligned with African cultural preferences.

The social impact considerations of esports betting development across Africa deserve particularly thoughtful attention given the scale of potential market growth and predominantly young audience demographics. Developing responsible, sustainable ecosystems requires balancing legitimate entertainment opportunities with appropriate protections for vulnerable individuals. Industry self-regulation initiatives have begun emerging, with leading operators establishing standards beyond minimum compliance requirements. These responsibility commitments potentially set foundations for long-term sustainability while demonstrating the industry’s commitment to positive contribution within African communities.