The Future of Online Sportsbooks in Sub-Saharan Africa

The online sports betting industry in Sub-Saharan Africa stands at a pivotal moment of transformation, poised for unprecedented growth while facing unique regional challenges. Over the past decade, the continent has witnessed rapid expansion of digital betting platforms, evolving from basic text-based interfaces to sophisticated mobile applications capable of handling complex transactions. This expansion reflects broader technological adoption across African markets, where mobile internet penetration continues to increase dramatically year over year. Industry analysts project the Sub-Saharan sports betting market to grow at a compound annual rate exceeding 12% through 2030, outpacing global industry averages. This growth trajectory is reshaping entertainment habits, consumer financial behaviors, and digital economies across the region. As international operators increasingly focus on African opportunities and homegrown platforms scale their operations, the competitive landscape is becoming more sophisticated, driving innovation and raising standards throughout the industry.

Technological Innovations Reshaping African Sportsbooks

The technological foundation of online sportsbooks in Sub-Saharan Africa is undergoing profound evolution, with innovations addressing the region’s unique infrastructure challenges while simultaneously adopting cutting-edge global betting technologies. This dual development path has created betting platforms specifically engineered for African contexts while maintaining competitive features comparable to international standards. The most successful operators have mastered the delicate balance between lightweight applications that function in low-bandwidth environments and rich feature sets that meet rising consumer expectations. This technological revolution extends beyond mere platform optimization to encompass fundamental changes in how African bettors interact with sports content.

Digital transformation in the region’s online sportsbooks has increasingly focused on creating seamless, uninterrupted betting experiences despite connectivity limitations. Progressive Web App (PWA) technologies have gained particular traction, allowing betting platforms to function effectively even when internet connections are unstable or temporarily unavailable. These applications cache essential functionality and betting markets, enabling users to browse options and prepare bet selections offline before completing transactions when connectivity returns. This approach significantly reduces transaction abandonment rates, a critical metric for operators working in regions with inconsistent network coverage.

Mobile-First Innovation

The mobile-first development paradigm defines African sportsbook evolution, with operators building natively for smartphone environments rather than adapting desktop experiences. This approach recognizes that over 85% of online betting activity in Sub-Saharan markets occurs on mobile devices, with feature phones still representing a significant portion of this activity in certain regions. The latest innovations focus on ultra-lightweight applications that maintain core functionality while consuming minimal data, addressing one of the primary barriers to consistent engagement.

AI-Driven Personalization

Artificial intelligence implementation in African sportsbooks has advanced beyond basic recommendation engines to sophisticated systems that adapt entire betting interfaces to individual user behaviors. These systems analyze betting patterns, sporting preferences, and even typical connectivity conditions to create personalized experiences. For example, bettors experiencing frequent connectivity issues might automatically receive more pre-match betting options, while those with stable connections see more live betting opportunities prominently displayed.

Voice Interface Integration

Voice technology represents a particularly promising frontier for African sportsbooks, potentially overcoming literacy barriers that still limit market penetration in certain regions. Early implementations allow basic betting functions through voice commands in multiple African languages, with more sophisticated applications under development. This technology could significantly expand the addressable market by making sports betting accessible to populations previously excluded by literacy or technological familiarity requirements.

Regulatory Evolution and Market Formalization

The regulatory landscape for online sportsbooks across Sub-Saharan Africa is progressing through a critical maturation phase, with significant implications for market structure and operator practices. Current regulatory frameworks vary dramatically between countries, creating a complex patchwork of compliance requirements that challenges pan-African operators. However, a clear trend toward more comprehensive, digitally-focused regulations is emerging as governments recognize both the economic potential and social responsibilities associated with online betting. This regulatory evolution follows distinctive patterns across different Sub-Saharan regions, with East African countries generally implementing the most structured frameworks, while West and Central African nations show more varied approaches.

The formalization of previously gray markets represents perhaps the most significant regulatory development across the region. Countries including Nigeria, Ghana, and Uganda have implemented licensing regimes specifically designed for online operators, moving significant betting activity from unregulated to regulated environments. These frameworks typically include specific technical requirements for betting platforms, mandatory responsible gambling features, and structured taxation systems that provide government revenue while allowing sustainable operator economics.

Data Protection Frameworks

Emerging data protection regulations across multiple African jurisdictions are fundamentally reshaping how sportsbooks collect, process, and store customer information. Regulations modeled after the European GDPR are being adapted to African contexts, creating new compliance challenges for operators while potentially building greater consumer trust in regulated platforms. These protections are particularly important given the sensitive financial and identification data handled by betting operators.

Taxation Equilibrium

Finding sustainable taxation models remains a critical regulatory challenge, with several countries adjusting initial tax frameworks after recognizing unintended consequences of excessive rates. Kenya’s experience with betting taxation provides an instructive case study, where extremely high tax rates temporarily drove operators from the market before subsequent adjustments created more balanced economics. This learning process is informing regulatory approaches in other markets, with increasing recognition that moderate, stable taxation creates better outcomes than punitive or frequently changing structures.

Cross-Border Standardization

Regional economic communities like the East African Community and ECOWAS are beginning to explore standardized betting regulations that could simplify compliance for operators while maintaining consistent consumer protections across member states. These initiatives remain in early stages but represent promising developments toward more cohesive regional markets that could accelerate industry development while improving regulatory effectiveness.

Financial Integration and Payment Innovations

The future of online sportsbooks in Sub-Saharan Africa is inextricably linked to continued innovation in financial services integration. Payment processing remains both a critical challenge and opportunity for betting operators, with successful platforms distinguished by their ability to offer diverse, reliable transaction options tailored to local financial ecosystems. The remarkable success of mobile money systems across many African markets has created distinctive payment infrastructures unlike those found in other global regions, requiring specialized integration approaches rather than simply adopting global payment standards. This unique financial landscape continues evolving rapidly, with new fintech innovations regularly emerging from African technology hubs.

Payment fragmentation presents significant operational challenges, with successful operators typically needing to integrate dozens of payment channels to effectively serve pan-African markets. While mobile money dominates transaction volumes, bank transfers, card payments, and various voucher systems retain importance in specific regions and demographic segments. This complexity creates substantial technical overhead but also presents opportunities for differentiation through superior payment experiences. The most advanced platforms are developing unified payment layers that abstract this complexity from users, presenting consistent interfaces while handling integration differences behind the scenes.

- Integrated betting wallets with broader financial capabilities are emerging as a significant trend, with betting accounts increasingly functioning as multipurpose financial tools beyond gambling activities.

- Cryptocurrency adoption remains limited but growing, particularly in markets with currency instability or restrictive banking regulations that complicate traditional financial transactions.

- Instant withdrawal capabilities have become a critical competitive differentiator, with market leaders reducing payout times from days to minutes through automated processing and risk management systems.

- Micro-transaction optimization continues advancing to accommodate small-stake betting prevalent across many African markets, with successful platforms supporting transactions well below amounts typically viable in Western markets.

The bidirectional relationship between betting platforms and financial services providers represents one of the most interesting aspects of the African market’s development. Rather than merely implementing existing payment solutions, leading betting operators actively collaborate with financial partners to develop specialized transaction types, security protocols, and service integrations. This co-development process creates innovative financial capabilities that frequently extend beyond betting applications to influence broader fintech ecosystems across the continent.

User Experience Evolution and Customer Engagement

The user experience paradigm for Sub-Saharan African sportsbooks is undergoing fundamental reconsideration, moving beyond simple functionality toward sophisticated engagement strategies adapted to local preferences and behaviors. This evolution reflects both technological advancement and deepening understanding of African betting audiences, whose engagement patterns often differ significantly from those observed in more established markets. The most successful platforms have transcended generic international templates to create distinctly African betting experiences that resonate with local sports preferences, cultural contexts, and usage patterns.

Contemporary UX development in African sportsbooks increasingly focuses on reducing cognitive load through intelligent interface simplification. This approach recognizes that many users access betting services during brief moments throughout their day, often in challenging environments with multiple distractions. The resulting interfaces emphasize clear visual hierarchies, reduced text dependency, and streamlined betting processes that minimize required interactions. These principles apply across device categories but become particularly crucial for mobile interfaces where screen limitations intensify usability challenges.

Community-Centered Design

Community features represent a particularly important frontier in African sportsbook development, reflecting the inherently social nature of sports engagement across the continent. Leading platforms have implemented various social capabilities, including communal betting pools, tip sharing systems, and interactive leaderboards that create shared experiences beyond individual wagering. These features transform betting from solitary activity to community engagement, significantly increasing platform stickiness and session frequency.

Educational Integration

Educational components have emerged as surprisingly effective engagement tools, with betting guidance, sports information, and financial literacy resources generating substantial user interaction. This content serves dual purposes, simultaneously building user capabilities while increasing platform time and affinity. Advanced implementations use progressive disclosure principles to introduce concepts at appropriate moments within the betting journey rather than requiring separate educational sections.

Gamification Evolution

Gamification mechanics have evolved from simple loyalty points to sophisticated systems leveraging behavioral science principles to drive engagement. These systems typically incorporate variable reward schedules, achievement progression, and social recognition elements specifically calibrated for African user preferences. The most effective implementations maintain cultural relevance while avoiding exploitative engagement patterns that might trigger regulatory concerns or damage brand perception.

Market Consolidation and Investment Trends

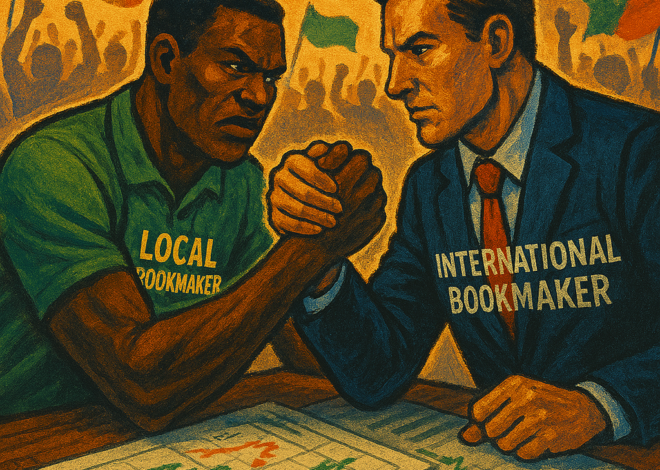

The online sportsbook landscape across Sub-Saharan Africa is experiencing accelerating consolidation as the industry matures, with clear stratification emerging between market leaders and niche operators. This consolidation phase follows predictable industry evolution patterns observed in other regions but exhibits distinctly African characteristics shaped by the continent’s unique market conditions. Significant investment has flowed into the sector over the past five years, with both regional and international capital sources recognizing the growth potential of African betting markets. This funding has disproportionately benefited operators with proven technology platforms and multi-country presence, accelerating consolidation through both organic expansion and acquisitions.

Market data indicates that the top five betting operators now control approximately 60% of regulated online betting volume across major Sub-Saharan markets, compared to roughly 40% five years ago. This concentration reflects both economies of scale in technology development and marketing efficiencies gained through multi-market operations. However, regional variations remain significant, with higher concentration in East African markets compared to West Africa, where more fragmented competitive landscapes persist. Despite this consolidation trend, the overall number of licensed operators continues increasing as new entrants target specialized market segments or emerging regional opportunities.

Recent investment patterns reveal growing sophistication in funding approaches, with capital increasingly directed toward specific technological capabilities rather than general market expansion. Payment processing innovations, data analytics systems, and customer relationship platforms have attracted particular investor interest, reflecting recognition that competitive differentiation increasingly depends on these specialized capabilities. This targeted investment creates potential for continued innovation despite market consolidation, as even smaller operators can access capital for clearly differentiated technology development.

International operator interest in African markets has intensified, with several major European and Asian betting companies establishing or expanding African operations through direct market entry or partnership with local operators. These international entrants bring significant capital resources and advanced technological capabilities but face challenges in adapting to distinctly African operational environments. The most successful international expansions have maintained flexible adaptation to local conditions rather than simply transplanting existing models, recognizing that African betting markets require specialized approaches despite apparent similarities to more established regions.

Responsible Gambling and Social Impact Considerations

The future sustainability of online sportsbooks in Sub-Saharan Africa depends significantly on the industry’s ability to address responsible gambling challenges and demonstrate positive social impact. As markets mature and regulatory frameworks evolve, these considerations are gaining importance for both compliance requirements and brand positioning. Forward-thinking operators are proactively developing comprehensive responsible gambling programs rather than implementing minimum required measures, recognizing that sustainable growth depends on maintaining social license through ethical practices. This approach represents significant evolution from earlier industry phases where responsible gambling received limited attention in many African markets.

Responsible gambling technology implementation is advancing rapidly, with sophisticated systems now able to identify potentially problematic behaviors through pattern recognition and predictive modeling. These tools analyze betting frequency, stake progression, chasing behaviors, and other indicators to flag accounts showing signs of potential harm. Leading operators have implemented graduated intervention systems that begin with subtle behavioral nudges before progressing to more direct interventions for accounts displaying serious risk patterns. The effectiveness of these systems continues improving as more African-specific behavioral data becomes available, allowing for more culturally appropriate risk assessment.

The industry’s relationship with community stakeholders is evolving from transactional corporate social responsibility toward more integrated impact approaches. Several major operators have established foundations or dedicated programs addressing issues including youth education, financial literacy, and sports development. These initiatives increasingly incorporate measurement frameworks to demonstrate tangible outcomes rather than simply reporting activity metrics. This evolution reflects growing recognition that betting’s social acceptance across African communities requires demonstrable contribution beyond entertainment provision and tax contributions.

Research collaborations between operators and academic institutions represent a particularly promising development, with several initiatives now gathering longitudinal data on betting behaviors and potential harm indicators specific to African contexts. These collaborations help address significant knowledge gaps regarding gambling behaviors in predominantly young, rapidly changing societies with limited previous exposure to commercialized betting. The resulting insights inform both operator practices and regulatory frameworks, potentially creating more effective protections while allowing continued market development.

The long-term reputation of online sports betting across Sub-Saharan Africa remains unresolved, with public perceptions varying significantly between different communities and stakeholder groups. The industry’s future acceptance largely depends on whether operators can demonstrate responsible commercial practices while contributing meaningfully to broader economic and social development. This challenge requires sustained commitment to ethical standards beyond minimum compliance, particularly as betting becomes increasingly accessible across diverse demographic segments.

Technological Convergence and New Betting Frontiers

Emerging technologies are creating entirely new betting frontiers across Sub-Saharan Africa, potentially transforming core aspects of the sports betting experience while opening previously unexplored market segments. These innovations extend beyond incremental platform improvements to represent fundamental paradigm shifts in how betting products are conceptualized, delivered, and experienced. The continent’s technological leapfrogging tendencies, demonstrated through previous adoption patterns in mobile money and digital services, suggest these advanced capabilities may achieve mainstream adoption more rapidly than observed in other global regions. This technological convergence is creating hybrid betting experiences that combine elements from different entertainment categories, potentially expanding appeal beyond traditional sports betting demographics.

Augmented reality applications represent particularly intriguing possibilities for African sportsbooks, with early implementations allowing virtual viewing experiences for sporting events through basic smartphone cameras. These technologies potentially address critical infrastructure limitations that currently restrict live sports consumption, creating immersive viewing options even in locations without reliable broadcast access. More advanced applications overlay betting information and opportunities directly onto real-world sporting environments, creating seamless connections between physical events and digital wagering.

Virtual sports have already gained surprising traction across various African markets, but next-generation implementations are blurring distinctions between simulation and reality. Advanced AI-driven simulations incorporating actual team and player statistics create experiences that closely mirror real sporting outcomes while operating continuously without schedule limitations. These products have proven especially valuable in maintaining engagement during seasonal gaps in major sporting calendars, while their lower bandwidth requirements compared to video streaming make them particularly suitable for markets with connectivity challenges.

The convergence between betting and broader entertainment forms represents another significant frontier, with several operators exploring gaming mechanics that incorporate actual sporting outcomes as victory conditions or progression elements. These hybrid products potentially attract users who might not engage with traditional fixed-odds betting but enjoy competitive gaming experiences. Similarly, sports-themed prediction markets using simplified interfaces are showing promise in reaching demographics traditionally less engaged with conventional betting formats.

The integration of betting functionality with existing social platforms represents perhaps the most transformative frontier, potentially embedding wagering options within the digital environments where users already spend significant time. Early experiments with betting mini-apps within messaging platforms have shown promising engagement metrics, particularly among younger users. These integrations potentially reduce acquisition costs while creating more natural, socially-embedded betting experiences that differ significantly from dedicated betting applications.